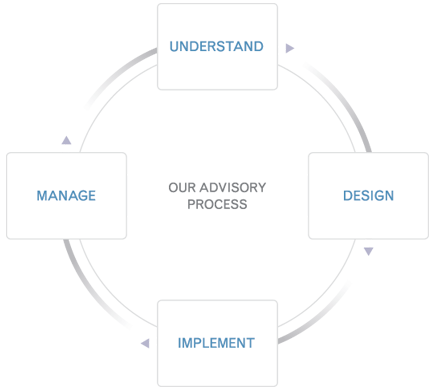

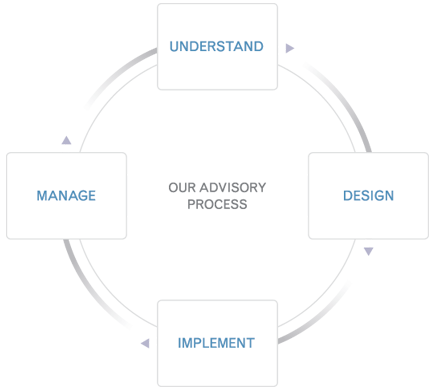

A well-defined process

for developing your wealth management plan

We use an established and well-structured advisory process to enable us to personalize a wealth management plan to your specific needs, goals and situation. Here is an outline of the steps we'll follow. It provides a framework for making our recommendations, collaborating with your outside advisors and monitoring the progress of your plan.

-

STEP 1: UNDERSTAND

We begin with a face-to-face meeting – to gain a thorough understanding of important things such as your personal goals, current financial situation, investment experience and risk tolerance.

-

STEP 2: DESIGN

We analyze the information you've shared and begin to customize your plan. This step may include collaborating with other professional advisors such as your accountant and lawyer. We present our recommendations, answer your questions and outline the steps to implement your plan.

-

STEP 3: IMPLEMENT

With your approval, we execute your customized plan. This involves the selection of specific account types, investment products and optional services, and the handling of all paperwork.

-

STEP 4: MANAGE

We continually manage the progress of your plan relative to your objectives, suggest any changes when needed, and provide reporting of your account activity.