Seven portfolio models

to address multiple investor objectives

No two investors are alike in their goals and risk tolerance. This is why Rick Meeks has developed and offers seven different risk-based strategies – to meet a wide range of client objectives. He can also customize each of these portfolios to allow for specific needs such as liquidity and tax management.

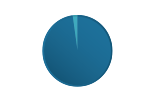

Portfolio 1 | Core Fixed Income

A global asset allocation portfolio designed for a more conservative investor and one seeking income as a primary objective. The portfolio is invested primarily in global fixed income and, to a small extent, high-dividend-paying equities.

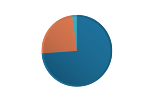

Portfolio 2 | Core Fixed Income With Growth

A global asset allocation portfolio designed for a more conservative investor and one seeking income as a primary objective. The portfolio is invested primarily in global fixed income and high-dividend-paying equities, and seeks to provide a high degree of income with a minor focus on growth.

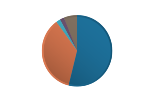

Portfolio 3 | Balanced With Income

A global asset allocation portfolio designed for a more moderate investor and one seeking both income and growth with slightly more emphasis placed on income. The portfolio is invested in global fixed income, high-dividend-paying global equities, global real estate and global growth equities.

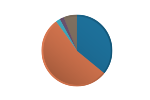

Portfolio 4 | Balanced

A global asset allocation portfolio designed for a more moderate investor and one seeking both growth and income with slightly more emphasis placed on growth. With a target allocation of 60% equity and 40% fixed income, the portfolio seeks to provide a moderate level of growth and income.

Portfolio 5 | Balanced With Growth

A global asset allocation portfolio designed for a growth investor, seeking both growth and income with more emphasis placed on growth. With a target allocation of 80% equity and 20% fixed income, the portfolio seeks to provide a higher level of growth with income as a secondary objective.

Portfolio 6 | Equity

A global asset allocation portfolio designed for a growth investor. The portfolio is invested in a mix of global equities. With a target allocation of 100% equity, the portfolio seeks to provide a high level of growth.

Portfolio 7 | Equity Enhanced

A global asset allocation portfolio designed for a more aggressive growth investor. The portfolio is invested in a mix of global equities, weighted more toward small and mid-cap offerings. With a target allocation of 100% equity, the portfolio seeks to provide a high level of growth.

There is no assurance that any investment strategy will be successful. Asset allocation and diversification do not ensure a profit or protect against a loss. The charts and tables presented herein are for illustrative purposes only and should not be considered as the sole basis for your investment decision. There is an inverse relationship between interest rate movements and fixed income prices. Dividends are not guaranteed and must be authorized by the company’s board of directors. It is important to review the investment objectives, risk tolerance, tax objectives and liquidity needs before choosing an investment style or manager. International investing involves special risks, including currency fluctuations, different financial accounting standards, and possible political and economic instability. Be advised that investments in real estate, REITs, and commodities have various risks. It is important to review the investment objectives, risk tolerance, tax objectives and liquidity needs before choosing an investment style or manager.